carefreeoufc

Active member

- Joined

- 7 Dec 2017

- Messages

- 954

Indeed.

It will probably be very difficult to get any action initially too!

In all honesty, as much as the quick multi bag is a joy, the bigger picture a few years down the line will make the initial placings look very cheap anyway, I should hope

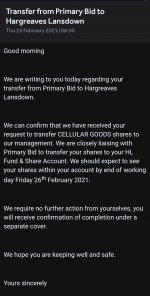

I am registered for the IPO alerts with HL but for some reason I don't seem to always pick them up.

I‘m in on Kanabo directly, but at 33 p (so much higher than I would have preferred) but still looking much longer term. Also Vela Tech are invested, although their investment was only £150k so whilst their share price moved it was significant.

A huge touch of fomo I think, me included.

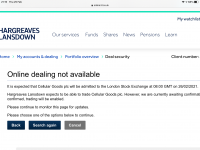

Been thinking a lot about this. I have an as yet unknown quantity that will be going into my GIA (and that I may not be able to trade even if I wanted to on the day) at 05p and a similar amount to one side for my ISA.

I think this is going to be a lot like KNB and there’s going to be a very big and quick rise followed by quite a bit of profit taking. Unlike KNB I think you’re quite likely to see less of an impact of the sale as there are so many people that will be looking at picking those up... either with a very low average already or because they didn’t go through PB.

Im still considering what will happen in my head and I may well be wrong but who knows. As it stands I’m looking to buy in on the day with my ISA and sell off most for the first spike (like people have done with KNB) and then leave the GIA there in the background and see what happens long term.

Ive read some of the stuff on LSE on MXC (who I’m holding LT) and KNB and I think some people have definitely bought in on the “next GameStop” for both. Both different companies and both with plenty of potential. I think there’ll be a bit of madness before it settles down and we see some RNS out there with what you’d call investable information (excluding the recent MXC one).

Who knows!!